By Marjon Muizer

With the new super rules in force, you may have made adjustments to your contribution and pension levels. When thinking about retirement savings strategies, consider also what you can do for your kids or grandchildren — or what they can do for themselves.

What are your children or grandchildren thinking about now? Maybe the internet, an overseas trip, clothing or a new car. But one thing they’re probably not thinking about is retirement savings, which always seems an eternity away until it actually arrives. If your children are working, it’s likely their employer is contributing to their super which they need to keep an eye on.

As a parent or guardian, you can assist by helping your children build up their retirement savings early. Remember the power of compound interest — the longer the time an amount is invested the greater the effect of compounding. Consider the following scenario.

Jolene and Darren’s youngest son, Nick, is 21 and still lives at home. He works part-time and is in his final year of his studies. Nick lives solely in the moment and pays little attention to his financial future, which Nick’s parents are concerned about. They know too well that when they retire their super will end up as their main source of income, and that Nick needs to appreciate the value of super before it’s too late.

There are a number of concessions Nick may qualify for when he is young that may increase the amount he eventually retires with. These include the low-income superannuation contribution, government co-contribution, and the use of contribution tax deductions. With these concessions, a little bit can go a long way.

Nick earns $30,000 p.a. from his part-time job at the local hardware shop and may qualify for the low income superannuation tax offset (LISTO), designed to offset the tax Nick's super fund pays on his contributions.

Under this measure, applicable for those with incomes up to $37k, Nick will receive a LISTO contribution equal to 15% of his annual total concessional super contributions, capped at $500. The LISTO is paid directly to his super account by the ATO, providing the fund has a record of Nick’s tax file number.

When Nick completes his studies in the next few months he expects to commence his first full-time job on a starting salary of $36,000.

If he makes an after-tax contribution to his super, he may qualify for a top-up contribution from the government, known as a co-contribution.The maximum co-contribution for the 2017/18 financial year is $500, based on a $1,000 personal contribution and an annual income of $36,813 or less. For incomes over this amount the maximum co-contribution reduces, with incomes of $51,813 or greater ineligible for a co-contribution.

If an after-tax super contribution of $1,000 is made by or on behalf of Nick, a co-contribution will give him a return of 50% plus any earnings in the fund on the combined contribution. At retirement, this will accumulate to over $29,442, if the fund has an average return of 7% p.a.

In a few years’ time, Nick may consider making additional contributions to super either by salary sacrificing or making personal deductible contributions.

As part of the new rules from 1 July 2017, anyone can claim a tax deduction for contributions made to superannuation.

Making personal tax-deductible contributions would require Nick to transfer after-tax monies into super, for which he can subsequently claim a tax deduction.

As an alternative, Nick can ask his employer to make additional contributions to super on his behalf from his pre-tax salary, known as salary sacrificing. The amount contributed will be taxed in the fund at 15%, instead of at Nick's marginal rate were he to receive the money as normal salary.

Personal tax-deductible contributions and salary sacrifice contributions are taxed in the superannuation fund at 15% and both strategies will achieve the same tax effect for Nick.

Salary sacrificing is a hassle-free form of voluntary tax-effective retirement savings. In contrast, personal tax-deductible contributions provide the flexibility to vary the amount based on the desired tax deduction.

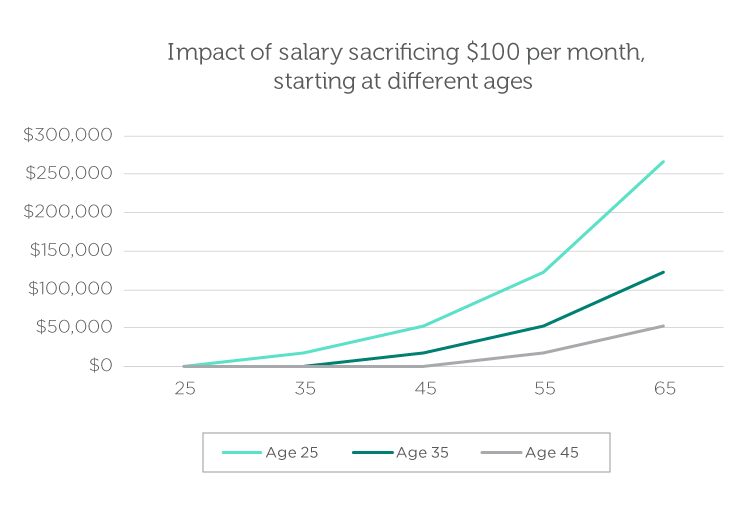

The chart below shows the impact of monthly $100 contributions, starting at age 25, 35 and 45, and with a rate of return of 7%.

If Nick starts salary sacrificing at age 25, his balance will grow by an additional $265,488 by the time he reaches 65. Starting at age 35 his balance will grow by an additional $123,191. And starting at age 45 — $52,523.

There are many potential strategies younger people can use now to make the most of their super. Taking advantage of these strategies will most likely do more for them than trying to catch up on their super balance later in life.