By Mark Ellem

Key points:

New law requires change to completing 2019 SMSF Return

The ATO has updated the instructions for completing the 2019 SMSF annual return in relation to SMSFs that have a limited recourse borrowing arrangement (LRBA) LRBA. This change was predicated by the passing of Treasury Laws Amendment (2018 Superannuation Measures No. 1) Bill 2019, which amongst other measures, includes the attributable outstanding loan amount of certain LRBAs from 1 July 2018 in a member’s total superannuation balance (TSB).

What is the change to the SMSF return?

The change affects label Y in Section F: Member information. This label has the description “Outstanding limited recourse borrowing arrangement amount”.

This label was added for the first time in the 2019 return in anticipation of the measure that was announced in the 2018 Federal Budget, to capture certain loan amounts that would be included in a member’s TSB. However, the relevant Bill lapsed when the 2019 Federal Election was called.

Whilst the label remained in the finalised published 2019 return, the ATO advised that:

As the Bill has been passed and the measure is now law, with effect from 1 July 2018, the ATO has announced the change to completing the label so as to only report amounts in accordance with the original Federal Budget announcement.

Consequently, when completing an SMSF’s 2019 annual return, reporting of an amount at this label only applies to:

Further, the member’s attributable value, as at 30 June, should only be included at the label, where:

Attributing loan amounts to members

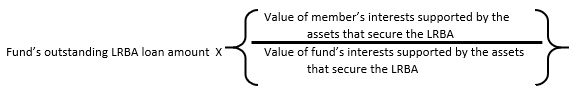

In the update, the ATO advises that they will accept any reasonable method of calculating the amount that needs to be reported. One method, which is acceptable by the ATO, is to calculate an affected member’s outstanding LRBA loan amount as follows:

Will an amount have to be reported for all members in an SMSF with an LRBA?

Short answer – No.

Only if the SMSF satisfies one of the above 3 scenarios is there an initial requirement to report an amount at the new label. The most common scenario will be where an SMSF has entered into a new LRBA since 1 July 2018. However, this alone does not mean that the SMSF has an amount to report for each member in section F of the return.

For the SMSF to be required to report a value at the new label for a member, that member must have an attributable value. This will only be the case if at least one of the two further above requirements are satisfied. This could mean that an amount is only reported for a particular member and not others.

For example, an SMSF entered into a new LRBA on 1 July 2018. The loan under the LRBA is with a commercial unrelated lender. The fund has 4 members, of which 2 of the members have satisfied a ‘condition of release with a nil cashing restriction’. Consequently, the attributable amount of the outstanding loan as at 30 June 2019 will only be reported at label Y in Section F for the member’s who have met the ‘condition of release with a nil cashing restriction’ and not for the other 2 members. However, if the loan under the LRBA was from an ‘associate’ of the SMSF, the attributable amount of the loan would need to be reported for all 4 members.

This will require a close examination of draft financial statements and return prior to finalising and lodgement to ensure the correct attributable amounts are only reported for affected members. It will also warrant a review of whether a member has satisfied a ‘condition of release with a nil cashing restriction’, which could be easily done by a member who simple ceases an employment arrangement after attaining age 60. But remember this is only required if the SMSF entered into the LRBA on or after 1 July 2018. If the LRBA was entered into before 1 July 2018, and a member whose benefit is supported by the LRBA asset satisfies a condition of release with a nil cashing restriction, no amount needs to be reported.

What’s the effect of reporting an amount for an affected member?

Where a member has an attributable LRBA loan amount that is reported at label Y in section F of the SMSF annual return, this amount will be included in the member’s TSB and may affect the member’s ability to make certain contributions. Many caps and concessions for a current financial year for a member are based on their TSB at 30 June prior. The inclusion of this attributable LRBA loan amount in the member’s TSB will add a further check box for member’s and their advisor to ensure that they do not exceed any relevant caps or are no longer entitled to certain concessions.

Further, considering that this amount will generally be calculated as part of finalising the prior year’s annual accounts, audit and return, there could be a considerable lag time in determining the amount, which may affect member and fund strategies for the current financial year. This is yet another layer of complexity the super reforms have provided that can trip up members and result in adverse tax outcomes.

What if my SMSF has already lodged its 2019 return prior to the change?

As noted above, prior to this recent ATO announce change to completing this new label, all SMSFs with an LRBA, regardless of when it was entered into, were required to calculate and report the attributable LRBA loan amount label. However, with this change, many SMSF who did provide a value at the label for members, would not have been required to do so, given the passage of the Bill into law and the updated ATO return instructions.

The ATO has noted that if you've already lodged your 2019 SMSF annual return, and are affected by this LRBA loan amount reporting measure, you may now need to amend your return. The ATO has further noted that they will contact affected SMSFs to determine whether an amendment is required.

In light of this change, SMSF accountants and administrators should review all 2019 SMSF annual returns which have so far been lodged and lodge an amended return if the fund had an LRBA in place at 30 June 2019, and the attributable LRBA amount is no longer required to the reported. Failure to do so may result in the member’s TSB at 30 June 2019 being materially overstated.