By Nicholas Ali

An alternative to an SMSF establishing a Limited Recourse Borrowing Arrangement (LRBA) is for the fund to invest in a unit trust. An advantage of a fund investing in a unit trust is that it allows the resources of various entities (including related parties) to be utilised to acquire a property. Investing in this way allows an SMSF to purchase an interest in real property (i.e. by acquiring units in the trust) which it may not otherwise be able to do on its own. The other parties can also borrow to finance their purchase of units.

However, before an SMSF invests in a unit trust, a key question the fund must determine is whether or not the unit trust is a ''related trust'' of the SMSF. If the unit trust is a ''related trust'' it will be subject to the in-house asset rules unless an exception to the rules applies (e.g. the trust meets the ''non-geared unit trust'' exception discussed below). In contrast, if the trust is ''unrelated'' to the SMSF it will be excluded from the in-house asset rules.

Section 71(1) of the SIS Act provides that an in-house asset of a superannuation fund is:

''…an asset of the fund that is a loan to, or an investment in, a related party of the fund, an investment in a related trust of the fund (emphasis added), or an asset of the fund subject to a lease or lease arrangement between a trustee and a related party of the fund.''

If a unit trust is a ''related trust'' of a superannuation fund then any investment in the unit trust cannot exceed 5% of the market value of the assets of the fund, unless an exception applies (see below for the applicable exemptions).

An investment in a unit trust will be excluded from the in-house assets rules provided the conditions stipulated in SIS Regulation 13.22C are satisfied. These conditions are as follows:

SIS Regulation 13.22D sets out the various events which affect whether the investment by an SMSF in a related non-geared unit trust continues to be excluded from the in-house asset rules. If any event in Regulation 13.22D is breached – such as an SMSF conducting a business or the trustee of the unit trust allows a charge to be placed over an asset – the investment by the fund in the unit trust ceases to be covered by the exclusion from the in-house asset rules relating to non-geared unit trusts. Furthermore, any future investment by the SMSF in that trust can never again be excluded from the in-house asset rules. If the investment then is greater than 5% of the fund's assets, the fund will need to divest itself of the investment.

Case Study 1

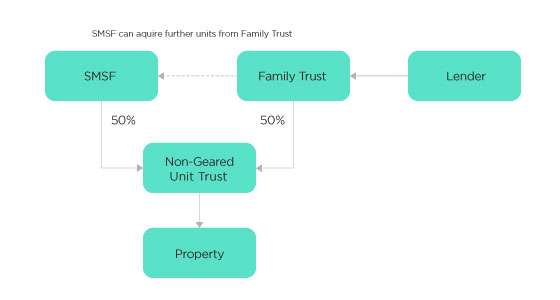

Richard wishes to purchase the premises through which he runs his business. The premises are in an industrial estate worth $600,000. Richard's SMSF – the Richard Superannuation Fund – has $300,000 to invest in the property, but Richard does not want his fund to enter into an LRBA to purchase the business premises. As an alternative, Richard decides to use his principle place of residence worth $800,000 (which is unencumbered) as collateral for a loan of $300,000, which he on-lends to his Family Trust (the Richard Family Trust). A unit trust is established, with Richard's SMSF and his Family Trust each owning 50% of the units issued.

The diagram below illustrates the structure:

As discussed above, some trustees of SMSFs may be reluctant to enter an LRBA for several reasons. Therefore, the non-geared unit trust arrangement may be more attractive for funds that are able to invest jointly with other parties with capital to invest. Alternatively, Richard, his SMSF, and another party could buy units in the unit trust 25%, 50%, and 25% respectively, or some other unit-holding arrangement (i.e. 4 parties owning 25% each, etc).

One of the great advantages of using a non-geared unit trust structure is the ability of the super fund to acquire units from other unitholders, even if they are a related party, without breaching the SIS Act or Regulations. This provides an option for SMSFs to gradually increase their stake in the unit trust as the fund balance grows, via contributions and rental income from the property.

That is, the fund is able to acquire units from a related party provided the units are acquired at market value and the non-geared unit trust continues to comply with the requirements in SIS Regulations 13.22C and 13.22D on a continuous basis.

The general prohibition regarding the acquisition of an asset from a related party (s66 of the SIS Act) does not apply if the SMSF acquires the units from the related party at market value, and the unit trust continually satisfies the conditions outlined above. It does not matter that the SMSF acquires existing units from a related party rather than new units being issued to the super fund; however, the fund can also acquire new units issued by the unit trust.

Case Study 2

Assume the same situation as in Case Study 1, but we are now 10 years into the future. The unit trust has continually satisfied the non-geared unit trust rules and, although the unit trust is clearly a ''related trust'', the investment by the fund is excluded from the in-house asset rules.

Over the last 10 years, the Richard Superannuation Fund has acquired units in the unit trust from the Richard Family Trust (commonly known as a ''creeping acquisition'' strategy) at the rate of 5% of the units on issue (i.e. the full 50% held by the Richard Family Trust). Furthermore, the units have been acquired at market value. The Richard Family Trust, as it receives the consideration for the units, uses the proceeds to reduce the loan, with the surplus distributed to beneficiaries listed under the Richard Family Trust.

The structure is now as follows:

Trustees should, however, obtain advice as to whether any stamp duty applies on the transfer of units. Most jurisdictions have a land rich regime which charges duty on certain transfers of units within a private unit trust if certain thresholds are exceeded. In Victoria, the land rich provisions apply if landholdings are more than $1m and the landholdings comprise 60% or more of the trust's assets. In New South Wales these thresholds are $2m and at least 60% of the value of all the trust's assets. Trustees should therefore seek State or Territory-specific advice on applicable land rich laws.

The SMSF can also reinvest any unpaid income (or capital) distributions owing from the non-geared unit trust into additional units in the trust. The ATO view in SMSFR 2008/D1 is that reinvestment of the unpaid trust distributions into additional units will be an investment for the purposes of the in-house asset rules in s71(1). However, provided the units in the unit trust were acquired at market value and the trust continues to satisfy the requirements contained in SIS Regulations 13.22C and 13.22D then the additional units will not be an in-house asset.

Re-investing income and capital entitlements back into the unit trust allows it to preserve working capital, and any income or capital distributed to the SMSF receives concessional tax treatment (i.e. maximum of 15% tax on income or 10% CGT whilst in accumulation phase and nil whilst in the pension phase).

There are many advantages associated with the ungeared unit trust structure. Some of the more obvious advantages are listed below:

Specialist advice should always be sought before undertaking any SMSF strategies or implementing structures. You should consult an appropriately qualified and experienced adviser before committing to any SMSF strategy involving non-geared unit trusts.