An SMSF’s Trust Deed usually authorises trustees to invest as permitted under the trust laws as well as the tax and superannuation laws. As a general rule, it may allow a wide range of investments and may actually name some of them in the deed, such as term deposits, equities, possibly bitcoin, artworks and collectables. However, there may be some investments that cannot be made by the fund because the trustee does not qualify as a sophisticated/wholesale investor as defined under the Corporations Law.

The Corporations Law recognises two types of investors – a retail investor and a sophisticated/wholesale investor. All investors are considered retail investors except those who qualify as sophisticated investors. A retail investor is required to be provided with some important documents before investing or making an investment. These will include a Financial Services Guide (FSG), Statement of Advice (SOA) and other regulated documents such as a Product Disclosure Statement for the particular investment. Retail investors also have access to consumer protection mechanisms and external dispute resolution schemes.

If an investor is a sophisticated investor, the Corporations Law provides an exception that disclosure documents are not required for the small-scale offerings of investments made under a personal offer. This is also referred to as the 20/12 rule. The 20/12 rule applies to offers or invitations made to fewer than 20 persons in the previous 12 months if no more than $2 million is being raised in that time. This exception allows anyone qualifying as a sophisticated investor to invest in a more diverse and complex number of investments that are usually considered to have a higher level of risk than many retail investments.

The reason for the distinction between retail and sophisticated investors is the perception that sophisticated investors have relevant investment experience and are considered to be better informed than retail investors. Because of this experience, it is argued that sophisticated investors don’t require the same levels of consumer protection that apply to retail investors. However, a sophisticated investor is still owed a duty of care by any licensee who has given advice or provided a product or service in relation to investing or the particular investment.

An investor can be treated as ‘sophisticated’ where one of the following three main tests are satisfied:

1. The price or value test – where the entry price of the investment for an individual or entity is $500,000 or greater.

2. The net assets or income test – which requires the individual or entity to obtain an accountant’s certificate from a qualified accountant not more than 6 months prior to the date of the offer document.The qualified accountant must certify that the client has net assets of at least $2.5 million or had a gross income for each of the previous two years of at least $250,000.The certificate is valid for two years.

A qualified accountant is someone who is a member of the CPAA1, CAANZ2 or IPA3 who hold approved designations.

3. Professional investor test – which requires an individual or entity to be a:

• financial services licensee,

• body regulated by APRA,

• superannuation fund, and

• person or entity who controls gross assets of at least $10 million (including any amount held by an associate or under a trust that the person manages).

An SMSF can qualify as a sophisticated investor if the trustee meets one of the above three tests. The test SMSF trustees meet most often is the net asset test which requires the trustee to have net assets of at least $2.5 million. Whether the trustee meets this test depends on whether the trustee of the SMSF is a company or is made up of individuals. The main questions to be answered are, what assets does the trustee ‘control’ and do they have a value of at least $2.5 million?

It is considered that a corporate trustee has control of the fund assets it holds as a legal, but not beneficial, owner. A company is considered to be controlled if a person has the capacity to determine the outcome of decisions about the company’s or trustee’s financial and operating policies. This would include a director of the trustee company who is able to determine the outcome of decisions concerning fund investments that are available to pay member(s) benefits. If the underlying value of the fund’s assets is greater than $2.5 million, then the corporate trustee will qualify as a sophisticated investor.

The Bedford Superannuation Fund is an SMSF that has three members, Terry, Linda and Cathryn. The total assets of the fund are valued at $3.2 million.

The balance of Terry’s balance in the fund is $1.5 million, Linda’s balance is $500,000, and Cathryn’s balance is $1.2 million.

The fund will meet the net asset test as the value of the assets controlled by the corporate trustee is greater than $2.5 million.

Where the trustees of the SMSF consist of individuals, the asset test operates in a slightly different way to a corporate trustee. Each individual trustee’s assets and what they control are considered separately when determining how the assets test applies.

The net assets test requires an individual trustee of the SMSF to have at least $2.5 million in assets.

This does not include the assets of the fund in the measurement as the individual is not presently entitled to a share of their assets of the SMSF until they vest. Vesting would usually occur for a member’s benefit when the individual trustee meets a condition of release.

In measuring the net assets of an individual, if some of the individual’s assets are owned as joint tenants, then each individual is considered to have an interest in the entire asset. For example, if a fund has two members who own property as joint tenants, which is valued at $2 million, each member will include the full value of the property when working out if they satisfied the $2.5 million assets test.

The Nerang Family Superannuation Fund (the Fund) is an SMSF and consists of four members of the Nerang family who are Fiona, Colin, Skye and Tegan, who are individual trustees.

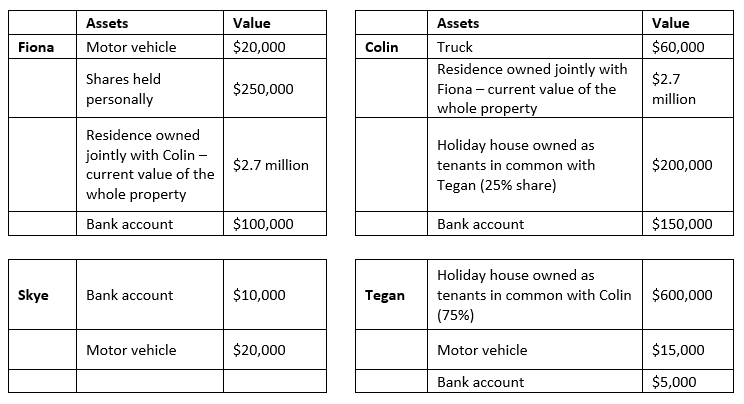

The total assets of the Fund are $2.7 million, and no member has yet satisfied a condition of release. Each member has the following assets:

The total assets of the Fund are $2.7 million; however, as the trustees are individuals, it is not possible for it to qualify as a sophisticated investor unless at least one of the trustees is able to qualify in their individual capacity. If the individual trustees were to be replaced by a corporate trustee, then it would qualify as a sophisticated investor.

As the trustees of the Fund are individuals and have not met a condition of release, the assets of each individual will be calculated to determine whether that particular trustee qualifies as a sophisticated investor.

In the circumstances of the Nerang Family, both Fiona and Colin are considered to have net assets of greater than $2.5 million as the full value of the property owned jointly by Fiona and Colin is used to calculate the total assets of each individual trustee.

Fiona’s total assets are $3.07 million, and Colin’s total assets are $3.11 million. Therefore they are both able to meet the assets test in determining whether they qualify as sophisticated investors.

Suppose an SMSF wishes to be treated as a sophisticated investor and gain access to small-scale offerings. In that case, there are a number of ways in which a corporate or trustee of an SMSF may qualify under the three tests available under the Corporations law.