The Australian Taxation Office (ATO) recently published the June quarter statistics for SMSFs, providing some interesting reading. For some time now, a younger demographic has been the principal driver in establishing SMSFs.

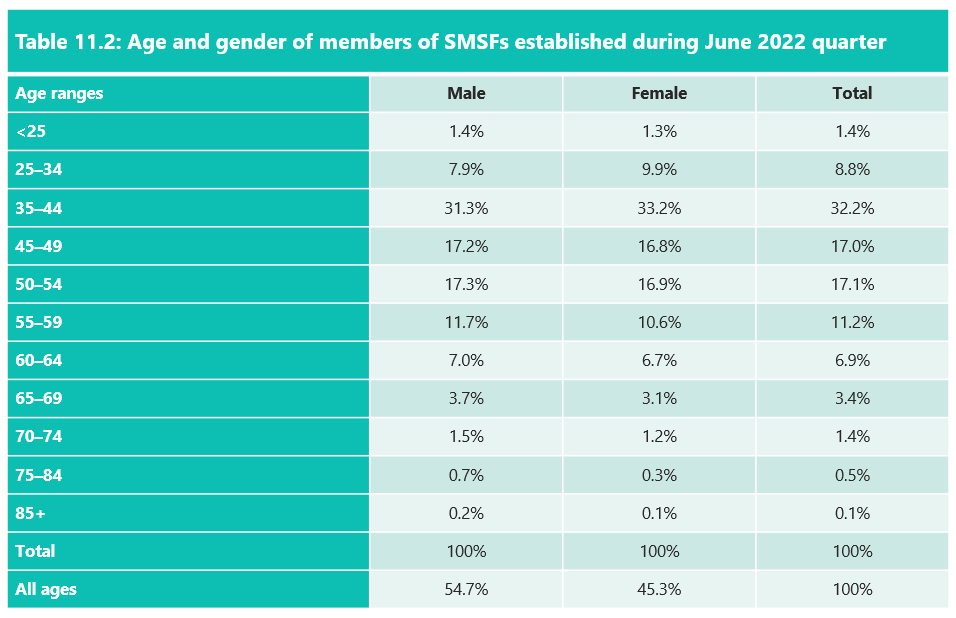

Below is an excerpt from the ATO’s June quarter statistics:

One can see that almost one-third of all new SMSFs established in the June 2022 quarter were done so by the 35-44-year-old age group. When the data is analysed further and expanded to include the 45-49 and 50-54 age brackets, almost two-thirds of all SMSFs established are done so by Generation X.

The term is typically used to describe the generation born in the late sixties to the early eighties, although some sources used slightly different ranges. It has sometimes been called the “middle child” generation, following the well-known baby boomer generation and preceding the millennial generation.

Generation Xers tend to be the older children of the baby boomers. They are the first generation to be introduced to computers, video games and the digitisation of the economy. Thus, they are a tech-savvy generation that gets their information from a wide variety of sources. They are also entrepreneurial, self-driven and independent thinkers. They are, in fact, the ideal candidate for an SMSF.

This demographic tends to have young or dependent children and high debt levels. Therefore, strategies that benefit an incapacitated member, or their beneficiaries in the event of their death, are of great importance.

Given that scenario, insurance policies through an SMSF may interest Gen Xers. The insurance proceeds can be paid to members, their spouses and children in a tax-effective manner. Also, the premiums for said insurance are paid by the fund rather than the member having to pay them personally (as an added bonus, the premiums may also be tax deductible). Therefore, death and TPD (total and permanent disability) insurance within the fund to cover the death or disability of a member is a prudent strategy.

However, in the unfortunate event of death or disability, there is an added benefit with policies of insurance that could result in substantial tax deductions for the fund to carry forward to future years. This is particularly attractive to Gen Xers with young families.

Rather than claiming the tax deduction for the insurance premiums in the relevant financial year, the SMSF instead claims a deduction for the bring-forward of future years’ deductions on premiums that would have been paid, providing insurance cover to the member up to retirement age (in the case of this particular strategy retirement age is considered 65).

This deduction can apply to a death benefit, terminal illness benefit, disability superannuation benefit or a temporary incapacity income stream payment.

The key benefit of this strategy is that the tax deduction claimed for future liability can be quite a large amount (depending on how far away the member is from age 65). The deduction created with this strategy may be greater than the deductions available for any future insurance premiums.

If the deduction available is substantial, the amount the fund does not use in the financial year can be carried forward to future financial years for the benefit of other fund members in the accumulation phase; to offset tax payable on assessable fund income and concessional contributions.

Again, an excellent strategy for this demographic, as it allows spouses and children to use the deduction for their benefit.

However, once the Trustee elects to claim a tax deduction for the future liability benefit, it cannot claim insurance premiums for other fund members in coming years.

That is the main reason it is a strategy that only applies to SMSFs.

The formula for the future liability deduction is calculated as follows:

Where:

• Benefit Amount = Is the total benefit

• Future Service Days = is the number of days from the date of termination to the members last retirement day (age 65)

• Total Service Days = is the sum of future service days plus the members eligible service period to the day of termination.

Let’s have a look at a case study to help explain the concept.

Richard, 48, is married to Sandy and has been a member of his fund since 30 June 1997 (or has an ESP of 30 June 1997).

His DOB is 1 July 1974.

The fund also owns a life insurance policy on Richard’s life for $1 million with an annual premium of $2,000.

His balance in the fund at the time of his death on 1 July 2022 is $500,000.

Sandy is to receive a death benefit lump sum which will be paid in the 2022/23 financial year.

The calculation, if using the future liability deduction is as follows:

• Benefit Amount = $1,500,000

• Future Service Days = 6,210

• Total Service Days = 15,342

• The Future Liability Tax Deduction = $1,500,000 x (6,210/15,342) = $607,157 tax deduction.

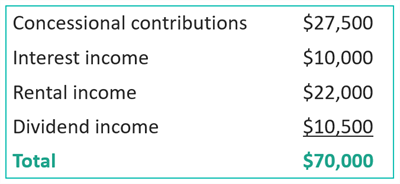

Let’s assume the fund has assessable income in 2022/23 as follows:

The tax deduction ($607,157) offsets the assessable income ($70,000) with the remainder ($607,157 - $70,000 = $537,157) is carried forward to be used to offset assessable income of the fund in future years.

Like all good things, however, there are some issues for consideration:

• The fund really needs to be in accumulation mode for the strategy to work

• If the fund is in pension mode, the carry-forward loss is offset against Exempt Current Pension Income (ECPI)

• For example, if a fund earns $100,000 whilst in pension mode, it is exempt from tax

• However, the $100,000 exempt earnings would be offset against any carry-forward deduction created by the future liability deduction.

Sandy could utilise the SMSF for concessional contributions – now and into the future and offset the 15% contributions tax. New members could also come into the SMSF and utilise the deduction to offset their concessional contributions. However, if Sandy wanted to commence an income stream in the future, she could utilise a second fund. If Sandy or other SMSF members wanted policies of insurance, they would need to utilise another fund.