This guide on paying death benefits covers the role trustees play in paying death benefits on a member’s death. It does not cover the taxation of death benefit lump sums or pensions to the beneficiary of the deceased or to the deceased’s estate.

A member may make a death benefit nomination which directs the trustee to pay death benefits to dependants and/or the member’s legal personal representative. In addition, where an SMSF is involved, the member may include additional conditions, including the type of benefit to be paid.

To be valid, a death benefit nomination should be binding on the trustee, which is in writing, nominate the relevant dependants and/or legal personal representative and signed by the member. However, the governing rules of the fund may provide a template nomination or indicate the types of information that should be included in the nomination. It may also include the format, form and procedures that the trustee is required to follow. It is also sensible for the trustee to acknowledge receipt of the nomination in writing.

Death benefit nominations can be binding or non-binding on the trustee and may also lapse after a pre-determined time or be non-lapsing. Whatever type of nomination a member wishes to put in place, it needs to be clear and unambiguous to ensure their directions can be carried out at they intended.

Where the member has been in receipt of a pension prior to their death it may include a reversion to a surviving dependant to continue to receive the pension. The name of the reversionary pension beneficiary will usually be nominated at the time the pension commences but the terms of the pension may be amended after it has commenced to include or exclude a reversioner.

If a member has not made a nomination or, for some reason the nomination is invalid then the fund’s trust deed will usually require that the trustee exercise discretion to determine who will receive the death benefit.

Documentary evidence to support the payment of a member’s death benefit should always be prepared to clearly show the information trustees relied upon in making their decisions.

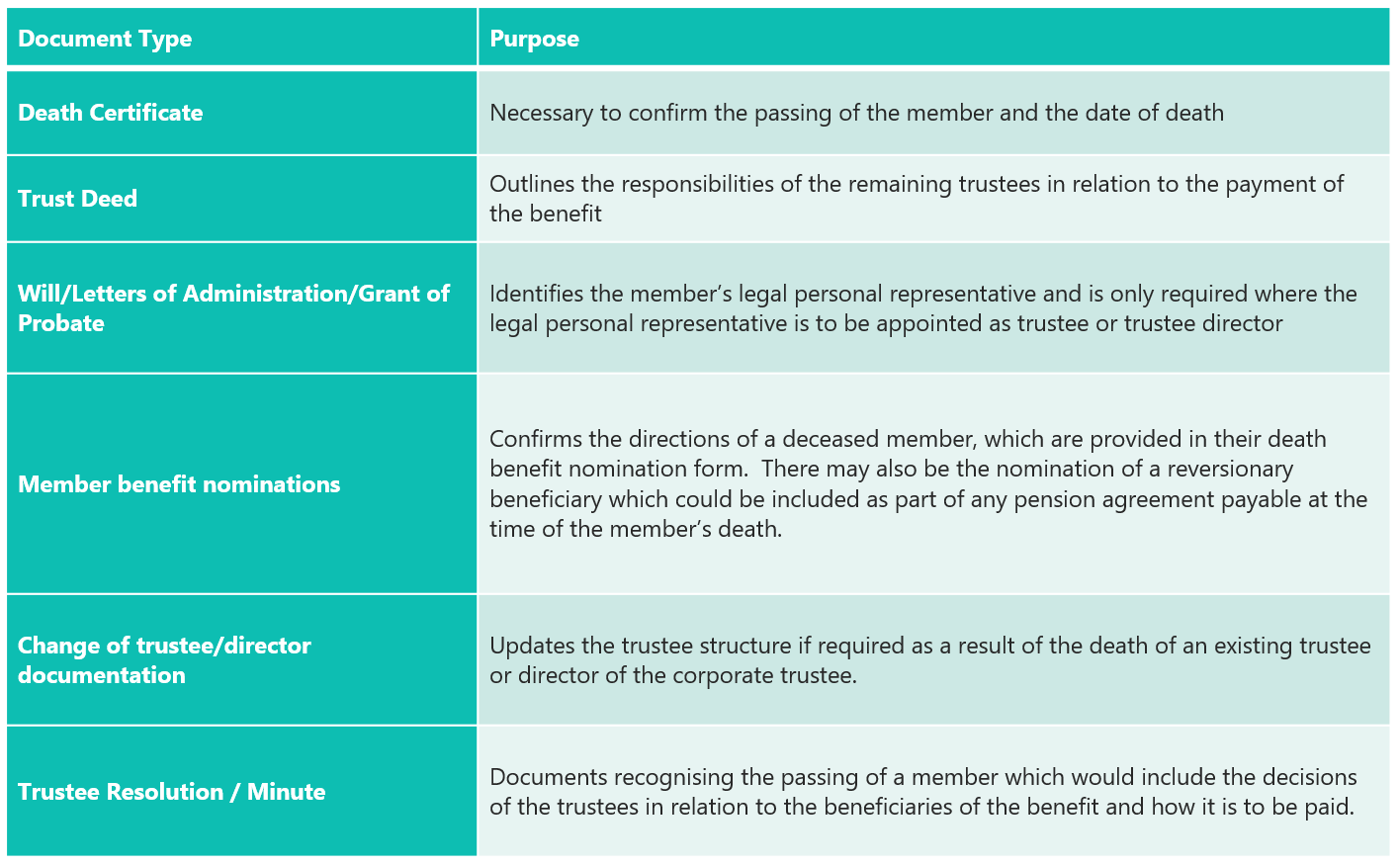

Here is a table of the most important documents to obtain when determining the payment of the death benefit:

When considering the member’s death benefit directions and the fund’s governing rules, the trustees will need to consider whether the death benefit can be paid as a lump sum, death benefit pension or reversionary pension.

Payment of a death benefit as a lump sum, is done by transferring either cash and/ or assets out of the fund to the beneficiary. Once this has occurred, the death benefit has left the superannuation environment.

Where the death benefit is paid as a new pension, commencement documents must be prepared. If the nominated beneficiary is not currently a member, they will be required to become a member and trustee or trustee director. The death benefit will remain in the fund, subject to the beneficiary’s transfer balance cap. The minimum pension is calculated based on the pension commencement date and the age of the beneficiary.

Where the death benefit is paid as a reversionary pension, the existing pension of the deceased simply continues to the new beneficiary. New pension commencement documents are not required as no new pension is established, and the original pension is considered to simply continue. The death benefit will remain in the fund, subject to the beneficiary’s transfer balance cap. The minimum pension in the year of death is calculated based on the age of the deceased and subsequently based on the age of the beneficiary.

Where the pension being paid is a non-reversionary pension, there is no requirement to make any further pension payments as at the date of death. The remaining amount of the non-reversionary pension will be added to the amount of the deceased member’s accumulation account. This amount will then be available for distribution to the member’s dependants and/or legal personal representative as determined by the member’s death benefit nomination, including the trust deed provisions.

Dealing with the death of a member can be overwhelming. Here are some key steps for trustees to consider:

1. Review the death benefit provisions of the trust deed for any relevant considerations;

2. Check if the deceased member has a valid death benefit nomination in place;

3. Document the decision in relation to the payment of the death benefit in writing. SuperConcepts can provide trustees with a death benefit payment resolution to complete;

4. Determine how the death benefit is to be paid, lump sum or pension or combination, and to whom;

5. Review any direct debit arrangements in place for payment of pensions to the deceased. Once the member has passed away, they can no longer receive pension payments.Where a reversionary pension is payable, make arrangements for it to be paid to the reversionary pensioner;

6. Organise payment of the death benefit, where the death benefit is paid as a reversionary pension; trustees may need to update the bank account details for the pension payments;

7. Register the fund for SuperStream purposes, where the death benefit will be rolled over to another superannuation fund;

8. Consider if any changes need to be made to the trustee structure of the fund;

9. Consider if any changes need to be made to authorities in relation to existing fund investments;

10. Update the death benefit nominations of existing fund members if required;

11. Ensure the fund auditor has access to the death certificate, any nominations the deceased member had in place, that the decision to distribute the death benefit has been made by authorised parties (the SMSF trustee) and that the ongoing trustee structure remains complying.